Why is it hard to stick to a budget?

You might ask yourself, “How do I force myself to stay on a budget?” The simple answer is you shouldn’t force yourself, you should build a habit of budgeting, slowly and stick to it.

Budgets require people to limit spending in certain categories, so if there is a family member’s monthly income that varies then it may become difficult for you to adhere to your budget.

So if you’re looking for tips on how to stick to a budget, keep reading!

P.S. Want to know when our next post lands and get our free ebook on how to live frugally? Then click the link below.

Sign up here to claim your free ebook!

What is the 50-30-20 budget rule? Is the 50-30-20 rule realistic?

A typical percentage budget has a 50/30/20 rule. It would be best to split your income into 3 categories: 50 % on needs, 30% on wants, and 20% on a savings account.

Some experts believe 50/30/20 doesn’t apply. Its budgets are often restrictive. For instance, 50% isn’t enough to satisfy the needs of the poor and low-income.

Tell me the rule of 30 days. Rather than giving up your impulse purchases, you should wait 30 days before you buy. This will mean that you’re going to defer any purchases necessary for at least ten days and up to 30 days, so you have plenty of time to decide what to buy, and whether you should even buy it.

How do I motivate myself to budget? Why can it be difficult to stick to a budget?

We recommend introducing some of these great ways of boosting motivation: Make friends with people who budget themselves and respect others’ budgets. Ask one of those friends to be your accountability partner. Use apps that help you save money quickly. Describe the reason(s) for wanting to start a budget. Get clarity on your reasons for wanting to budget. Visualize the objective: what should you do? Budget to enjoy. Make money reserves for emergencies! Find out what the budgeting process is.

When it comes to sticking to a budget, it can be difficult to stay on budget when income and spending vary daily. Reading this article and learning about budgeting is you taking the first steps to learn how to stick to a budget, so well done! And keep at it!

Left with no cash after covering your expenses?

Discover my top 2 strategies for living expenses and making the most of your income.

- Prioritize essential expenses: Focus on covering your basic needs first, such as housing, utilities, food, and transportation. Create a monthly budget that allocates funds to these essential expenses before allocating money for discretionary spending. This strategy ensures that you can maintain a stable lifestyle and avoid financial stress related to unmet basic needs.

- Optimize discretionary spending: After covering essential expenses, analyze your remaining income and identify areas where you can save money or get more value. Some tips to make the most of your income include:

a) Eliminating or reducing non-essential subscriptions and memberships.

b) Planning meals and shopping with a grocery list to minimize food waste and overspending.

c) Taking advantage of discounts, coupons, and sales to save on purchases.

d) Comparing prices and considering alternative options, such as generic brands or second-hand items.

e) Limiting eating out and entertainment expenses by finding free or low-cost activities and preparing meals at home.

f) Establishing a savings goal and setting aside a portion of your income for emergencies or future expenses.

By prioritizing essential expenses and optimizing discretionary spending, you can effectively manage your living expenses and make the most of your income, ultimately leading to greater financial stability and long-term success.

Do you ever feel like adhering and sticking to a budget should be much easier than it seems? Sometimes it seems like everyone else may know how to do it, but don’t be too hard on yourself, no one inherently knows how to stick to a budget. It’s a learned skill. Sticking to a budget can be challenging, but it’s not impossible. Keep reading to learn the secrets of maintaining a budget and eliminating debt.

Why is it Difficult to Stick to a Budget? & The Main Reason People Struggle with Budgetting

When you first embark on budgeting, you’re filled with motivation. Your search for budget templates and open Excel or an app. But after a while, you might start feeling overwhelmed. There’s a lot of information to input and a lot of guessing involved, so you might stop altogether, which leads to guilt.

Fortunately, there’s a simple solution to this issue.

The Main Reason People Struggle with Budgeting

The truth is, most individuals make their budgets overly complicated. Remember, managing finances and budgeting are skills and habits that require time and practice to develop.

Take exercise, for example. If you wanted to get in shape, you wouldn’t immediately jump into a marathon or an intense weightlifting session. You’d start small, like going for a walk or jogging a mile. The same concept applies to budgeting.

Avoid setting yourself up for failure by diving headfirst into complex Excel spreadsheets with intricate categories. Instead, create a straightforward budget that accommodates life’s unexpected events.

Lacking the Motivation to Stick to a Budget? Try These Strategies

Even if you have a budget, it’s worthless if you don’t adhere to it. So keep reading to learn how to stick to a budget. So, how can you stay motivated to stick to your financial plan? Here are two tactics to try:

Set a goal

Give yourself a reason to stick to your budget. It doesn’t have to be a monumental objective or savings goal, but having something to work toward can create a sense of urgency. Your financial goals now might include buying a new phone, treating your mom to dinner, saving for a road trip, or paying off debt. Whatever your aim, having something to strive for can make a huge difference.

Embrace a lifestyle change

Budgeting and financial management are learned skills and habits. To truly adhere to a budget, you need to adopt a frugal lifestyle, making it a habit that becomes second nature. Like temporary exercise regimens, casual budgeting can lead to a return to old spending habits. By committing to a budget based on a frugal lifestyle, you’ll become more conscious of your spending and continuously seek ways to save money.

If you are looking for tips on how to save money fast, read our article How to Save Money Fast: The Ultimate Guide to Saving $2,000 a Month.

Budgeting Tips and Tricks

Here are some additional pointers for successful budgeting:

Remember, there’s no one-size-fits-all approach to budgeting. Don’t feel guilty about using a method that works for you, regardless of how simple it may seem.

Customize your budget to suit your preferences. If you dislike Excel, don’t use it. If you prefer tracking expenses on your phone, that’s perfectly fine.

Focus on the long term. Immediate results may not be evident, but consistently overspending for months or years can have a significant impact and lead to crippling debt. But consistently sticking to a budget and saving can lead to great wealth over the long term

Aim for consistency, not perfection. If you overspend one month, don’t give up. Recognize the issue, adjust your next budget amount, and keep going.

Utilize a budgeting app to manage and monitor expenses

Smartphone or Online budgeting apps can greatly assist in comprehending your spending habits and planning monthly expenses. Notable free apps on iOS and Android, such as Money Dashboard, Bean, and Emma, can even link multiple bank accounts for comprehensive tracking. Understanding your spending enables better budget planning.

Using online banking facilitates offering easy money transfers to savings or current accounts and is a step in the right direction. But they also often allow you to just transfer money from your savings account or credit card into your current account for spending. So tread lightly and set up some savings accounts to which you don’t have immediate access.

Leverage online banking features to stay on top of spending

Online banking allows you to easily monitor transactions, your checking account, and your balances without waiting for mailed bank statements. Many online banks offer added budgeting features, like automatic transfers, purchase categorization, or virtual pots for setting money aside. Online banking provides financial access 24/7, even when branches are closed or inaccessible.

Meal planning for better budget management & Shop for groceries online to adhere to a tight budget plan

Meal planning is a fundamental budgeting tip, as food expenses can easily spiral out of control. Planning meals for the week ahead helps manage your food budget and minimize waste. Staying aware of your kitchen inventory reduces waste, saves money, and benefits the environment. Meal planning is useful even if you prefer pre-prepared food or dining out, as long as you factor it into your budget.

For some more tips about grocery shopping read our post 11 Tips For Cheap Groceries (How To Save Money On Groceries).

Online grocery shopping allows you to compare prices, remove items from the grocery list if costs get too high, and even compare costs between different supermarkets. Keep in mind delivery or collection fees, but online shopping may still be more cost-efficient than driving to the store. To avoid impulse buys, never shop online or in-store on an empty stomach.

Avoid overspending by leaving credit cards at home

Spending only from a current account and refraining from using credit cards can help control expenses. Removing credit cards from online shopping accounts and keeping them out of reach at home can help you use them more cautiously.

Plan ahead for social events and celebrations within your budget

Unexpected expenses can come in the form of social events or celebrations, so it’s important to factor them into your budget. Be mindful of more expensive times of the year, like Christmas.

Think twice before making large or non-essential purchases

Avoid impulse buying by sleeping on purchase decisions. Dividing your money, such as 50% for bills, 30% for savings, and 20% for discretionary spending, can help control the temptation of expensive non-essentials.

Eliminate unnecessary fees and subscriptions & Explore cost-effective alternatives

Cancel unused subscriptions and set reminders for trial cancellations to optimize your budget.

Cheaper alternatives can help stretch your budget further. Opting for more affordable dining options, store-brand products, or using coupons and vouchers can lead to significant savings on your grocery bill.

Set realistic budget goals

When setting budget goals, assess your financial situation and prioritize achievable objectives, such as paying off debt or saving for emergencies. For example, if you aim to save $200 per month, ensure that it’s feasible considering your income and necessary expenses. Adjust goals as needed to maintain a balance between financial progress and maintaining a comfortable lifestyle.

How to Stick to a Budget – Simple Strategies for Success

Discovering the most cost-effective way to manage your finances can be challenging. Questions about budgeting often arise, such as how to avoid overspending on rent or how to create an effective budget. To stick to a budget, one must make it a priority and continuously monitor their financial habits.

How to Stick to a Budget When Some Expenses Are Unpredictable

While you can’t control gas prices, you can plan for other expenses and transportation options. Consider your budget plans for fuel and other recurring costs.

Avoid Spending More Than You Have

Debt can be challenging to overcome, especially when you’ve spent more than you should. To avoid this, only spend what you can afford and make adjustments to your budget as needed.

Take Time to Consider Big Purchases

When contemplating significant purchases, take time to evaluate the pros and cons. If you find yourself forgetting about the item, it’s a good indication that you didn’t need it.

Ensure Your Budget is Realistic and Reflects Your Spending Habits

It’s okay to adjust your budget as long as you can afford the changes. Make sure to allocate funds to different categories based on your actual spending patterns.

Habit One: Assign Money When It Arrives

The next time your paychecks, birthday checks, or other money arrives, that is when you should enter that money into your account. It wasn’t earlier or too soon. Not only is boosting your payday going to make it more magical, you will also get the right mindset to just use the funds that are available to you. In YNAB, when someone holds a YNAB account and their paychecks automatically go through their bank account, that’s pretty automatic. Is that something I can’t remember doing?

Habit two: Never spend more than you have

The repercussions of getting into debt are often difficult to overcome. In some situations, you will have incurred more money than you should. If you’re in no position to pay what your budget allows then put this on hold until next weekend. Plan your vacation. Save regularly for a less than ideal cost. Eating noodles four days before a trip may not be your ideal lifestyle.

Habit Three: Check Your Budget Before Spending money

Before making any purchases, consult your budget to ensure you can afford them. Tracking your spending can help you make better financial decisions.

Monitor Your Emergency Fund

Having an emergency fund can prevent unexpected expenses from derailing your budget. Make sure to allocate funds in your budget for emergencies.

Try a No-Spend Challenge & Maintain a Low Credit Card Limit

A no-spend challenge involves committing to not spending money on non-essential items for a set period. This exercise can help you reassess your spending habits and save more money.

Keeping a low credit card limit can prevent accumulating debt that’s difficult to repay. Aim to spend only what you can afford to pay off without incurring interest.

Plan Your Meals & Think Weekly

Meal planning can help you save money and reduce food waste. Choose delicious, budget-friendly meals to keep your grocery expenses in check.

Breaking your budget down into weekly segments can help you manage your finances more effectively. This approach allows for better distribution and organization of your funds.

Establish Weekly Budgets for Certain Expenses

Short-term budgeting can help you manage variable expenses more effectively. This approach can prevent overspending early in the month, leaving you with limited funds later on.

Create a “Cheat” Category in Your Budget

A “cheat” category provides flexibility for occasional indulgences. Use this category for discretionary spending without breaking your budget.

How to Create a Budget You Can Stick To

Start with the basics and develop a solid foundation for your budget. Adjust your budget as needed to reflect changes in your lifestyle and expenses.

Cut Your Monthly Bills

Lowering your monthly expenses can make it easier to stick to your budget. Shop around for better insurance rates, subscription plans, and refinancing opportunities.

Find Ways to Make More Money

Increasing your income can help you achieve your financial goals. Look for opportunities to earn more money at work or through side jobs.

List Your Expenses

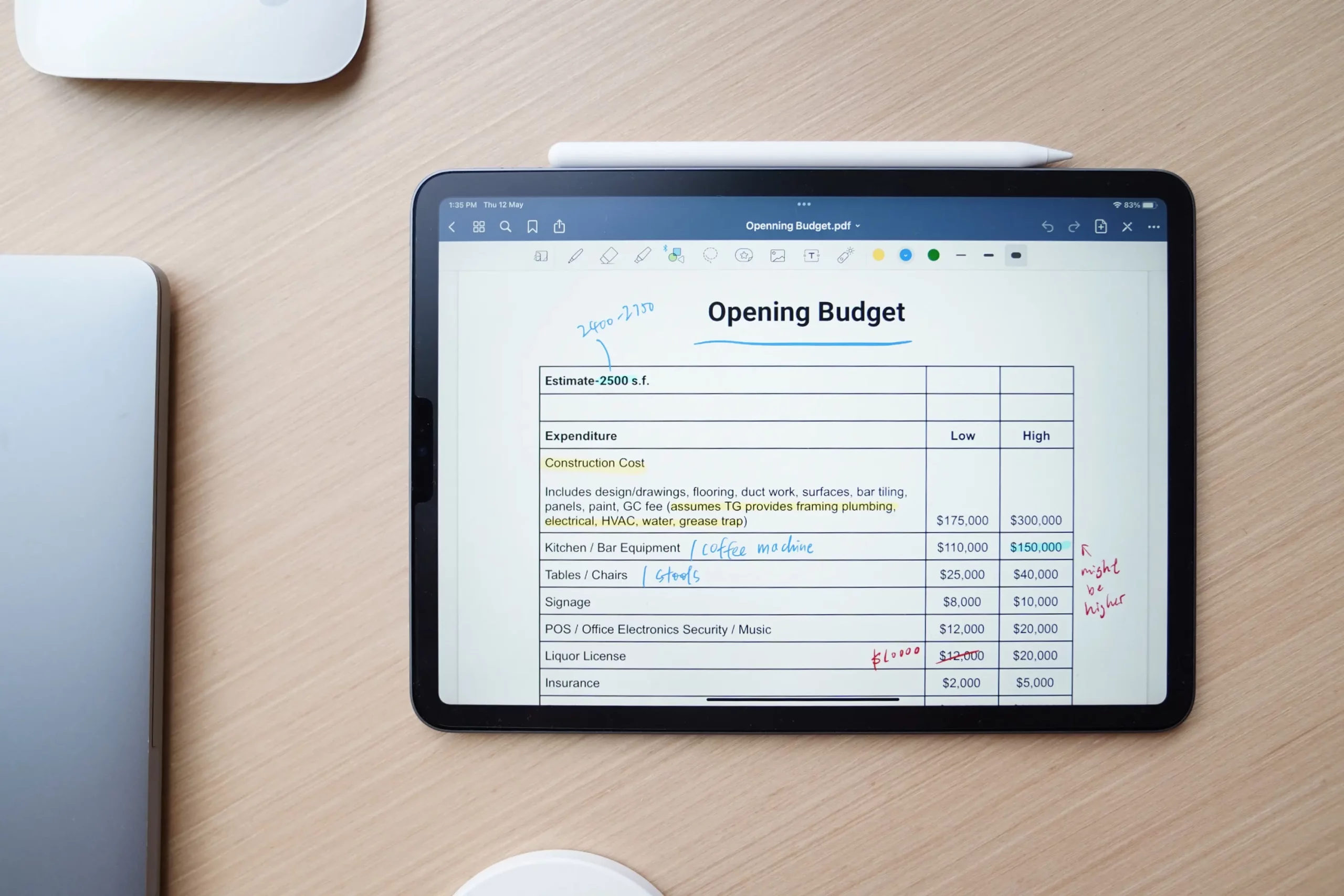

Begin by listing essential expenses, such as housing, utilities, and food. Don’t forget to include discretionary spending categories and occasional costs like haircuts and pet care.

Find a Money Accountability Partner or Community

Discussing finances with a trusted friend or partner can provide valuable insights and support. Be open to sharing your financial concerns and seeking advice from others.

Don’t Get Overwhelmed & Try Options Without Committing

Starting a budget can be challenging, but choosing the right budgeting tool can make the process more manageable.

Test various budgeting apps and tools to find the best fit for your needs. Many offer free trials to help you determine

In Conclusion

Adopting a budgeting mindset is a lifestyle change. Don’t stress about having a flawless budget that’s always accurate, as life is unpredictable. Instead, concentrate on making choices today that will benefit your future self. Take it!

Also read:

Budgets for beginners: A guide to creating and sticking to one

Crafting a Practical Budget: A Comprehensive Guide to Financial Planning

18 Actionable Steps for Millennials to Build a Strong Financial Future

Why Is It Hard To Save Money? (2 reasons)

Best Wedding Reception Order of Events for Your Big Day (4 steps to planning)

9 Frugal living tips for 2022 (and beyond)

10 Top Tips for Planning a Wedding on a Budget You’ll Love

15 Cheap Wedding Ideas to save thousands

P.S. Want to know when our next post lands and get our free ebook on how to live frugally? Then click the link below.