If you’re new to the world of budgeting, you’re not alone. Many people struggle with managing their finances and sticking to a budget, but it’s an important skill to learn.

In this Budgets for beginners guide, we’ll show you how to create a budget, gain control over your spending and save money for the things that matter most to you.

P.S. Want to know when our next post lands and get our free ebook on how to live frugally? Then click the link below.

Sign up here to claim your free ebook!

Here are 5 key tips for creating a budget that works for you:

Start by tracking your spending.

Before you can create a budget, you need to know where your money is going. Keep track of your spending for at least a month to get a clear picture of your income and expenses.

This will help you identify areas where you can cut back and make more informed decisions about where to allocate your money.

Also read: The 100 envelope challenge (with variations)

Set specific, realistic goals.

When it comes to budgeting, it’s important to have specific goals in mind.

Whether you want to save for a down payment on a house, pay off credit card debt, or build an emergency fund, having a clear goal will help you stay motivated and on track.

Be sure to set goals that are realistic and achievable, and break them down into smaller, monthly targets.

Create a budget that works for you.

There’s no one-size-fits-all approach to budgeting, so it’s important to create a budget that works for your unique situation.

Consider your income, expenses, and goals, and allocate your money accordingly. Be sure to include both fixed and variable expenses, and allow for some flexibility in case of unexpected expenses.

Automate your savings and payments.

To make sticking to your budget easier, consider automating your savings and payments.

Set up automatic transfers from your checking account to your savings account, and arrange for your bills to be paid automatically.

This will help you save time and avoid the temptation to overspend.

Review and adjust your budget regularly.

Your budget is not set in stone, so be prepared to review and adjust it as needed.

As your income and expenses change, you may need to adjust your budget to reflect your new reality.

Regularly reviewing your budget will also help you identify areas where you can make improvements and stay on track with your goals.

How to create budgets for beginners: Step-by-step instructions on how to set up a budget, including determining income and expenses and tracking spending.

- Determine your income: The first step in creating a budget is to determine how much money you have coming in. This includes your regular income from employment, as well as any other sources of income such as investments or freelance work.

- Identify your expenses: Next, make a list of all of your regular expenses, such as rent or mortgage payments, utilities, groceries, and transportation costs. Be sure to include both fixed expenses (those that stay the same each month) and variable expenses (those that fluctuate from month to month).

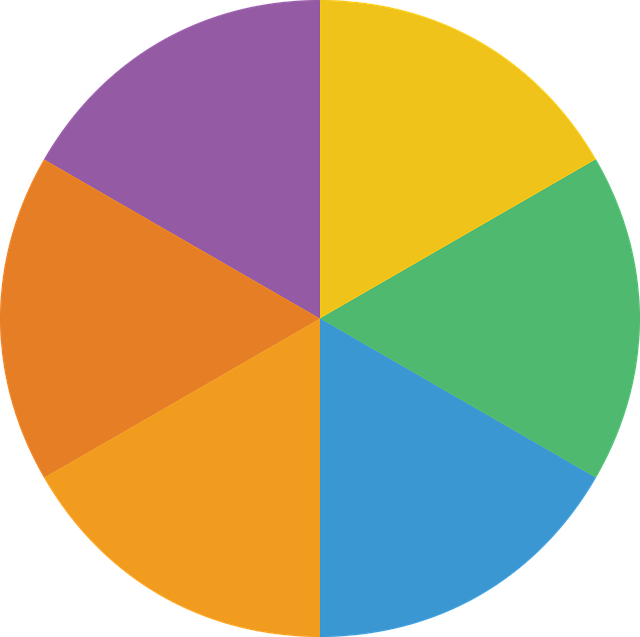

- Track your spending: To get a better understanding of where your money is going, track your spending for a few weeks or a month. This can help you identify areas where you may be overspending, such as dining out or impulse purchases.The easiest way to do this is to go through at least 3 months’ bank statements and categorize fixed and variable expenses, and input this into a spreadsheet.

- Create a budget plan: Using the information you’ve gathered about your income and expenses, create a budget plan that outlines how much money you will allocate to each expense each month. Be sure to account for both fixed and variable expenses, and try to allocate enough money to cover your needs without overspending.

- Make adjustments as needed: As you begin following your budget, you may find that you need to make adjustments. This could include cutting back on certain expenses or finding ways to increase your income. Don’t be afraid to make changes to your budget as needed to help you stay on track.

Also read: Ultimate cheap grocery list: How to Save Money on your bill

Common budgeting mistakes: 5 Common pitfalls to avoid when creating and sticking to a budgeting for beginners

- Not including all expenses: It’s important to be thorough when identifying your expenses and to include all of your regular bills and expenses, as well as any occasional or irregular expenses. Failing to include all of your expenses can lead to overspending and make it difficult to stick to your budget.

- Not leaving room for flexibility: While it’s important to have a plan for your money, it’s also important to be flexible and allow for some wiggle room in your budget. This can help you avoid feeling overwhelmed or restricted by your budget and make it easier to stick to it.

- Not setting specific financial goals: Setting specific financial goals can help you stay motivated and focused when creating and following your budget. Without goals, it can be easy to lose sight of your long-term financial objectives and make budgeting less effective.

- Not reviewing and adjusting your budget regularly: Your financial situation and needs can change over time, so it’s important to review and adjust your budget regularly to make sure it still reflects your current circumstances. This can help you stay on track and avoid overspending.

- Not seeking help when needed: If you’re having trouble creating or sticking to a budget, don’t be afraid to seek help. This could involve working with a financial planner or counselor, joining a support group, or using budgeting tools or resources.

Conclusion

In conclusion, creating a budget is a valuable skill that can help you gain control over your spending and save money for the things that matter most to you.

By tracking your spending, setting specific goals, creating a budget that works for you, automating your savings and payments, and regularly reviewing and adjusting your budget, you can set yourself up for financial success.

P.S. Want to know when our next post lands and get our free ebook on how to live frugally? Then click the link below.